By: Davette Lynne Hrabak, CPA, CFE, CBM, ATA, ATP, ABA, ECS, CGMA, https://www.DavetteLynneHrabak.com

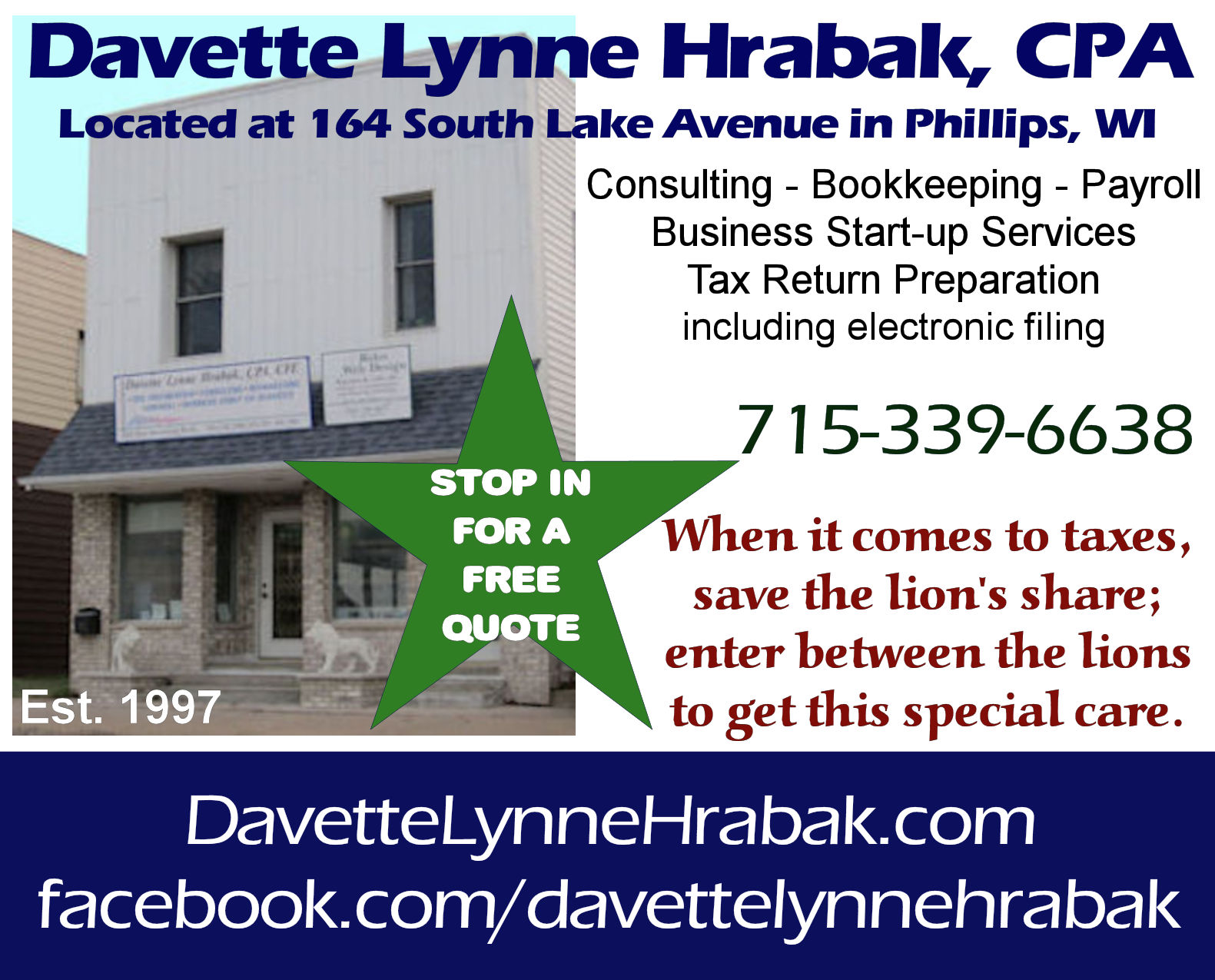

“When it comes to taxes, save the lion’s share; enter between the lions to get this special care.”

As you have heard about and may have received during 2020 and/or 2021, there were multiple economic impact payments. It is a credit that is issued as an advanced refund to eligible individuals.

Taxpayers will need to reconcile their economic impact payments that they received with their Allowable Recovery Rebate Credit on their 2021 income tax return. The amount of the allowable credit will be reduced, but not below zero, by the economic impact payment received.

There have been some changes and modifications to this for 2021. However, one of the changes that people may be interested in is that an individual who was not an eligible individual for 2019 or 2020 may become an eligible individual for 2021. One situation that causes this to occur is where an individual was a dependent for 2019 or 2020 but is not for 2021. The IRS will not and has not sent out advance rebates to these individuals because advance rebates are based on information on the 2019 or 2020 returns. Therefore, an individual falling into this category will be able to claim the credit when filing a 2021 return if they meet all the other criteria.

Remember, if you have already filed but realize that you could have had a credit or deduction that you missed, it is not too late; you can always amend your return. If you need more information or believe you could qualify for them, I would be happy to give you a free quote on the preparation of your return.

When the right tax and financial advice is essential, talk to someone with an unmatched level of knowledge, experience, and education. A CPA understands the business of taxes and finance and can provide trusted advice and services during the tax season and throughout the calendar year.

For a free, no obligation quote, call Davette at 715-339-6638. Her office is located between the lion statues at 164 South Lake Avenue in Phillips.

(This post was last modified: 02-24-2022, 02:44 AM by My Northern Wisconsin.)

“When it comes to taxes, save the lion’s share; enter between the lions to get this special care.”

As you have heard about and may have received during 2020 and/or 2021, there were multiple economic impact payments. It is a credit that is issued as an advanced refund to eligible individuals.

Taxpayers will need to reconcile their economic impact payments that they received with their Allowable Recovery Rebate Credit on their 2021 income tax return. The amount of the allowable credit will be reduced, but not below zero, by the economic impact payment received.

There have been some changes and modifications to this for 2021. However, one of the changes that people may be interested in is that an individual who was not an eligible individual for 2019 or 2020 may become an eligible individual for 2021. One situation that causes this to occur is where an individual was a dependent for 2019 or 2020 but is not for 2021. The IRS will not and has not sent out advance rebates to these individuals because advance rebates are based on information on the 2019 or 2020 returns. Therefore, an individual falling into this category will be able to claim the credit when filing a 2021 return if they meet all the other criteria.

Remember, if you have already filed but realize that you could have had a credit or deduction that you missed, it is not too late; you can always amend your return. If you need more information or believe you could qualify for them, I would be happy to give you a free quote on the preparation of your return.

When the right tax and financial advice is essential, talk to someone with an unmatched level of knowledge, experience, and education. A CPA understands the business of taxes and finance and can provide trusted advice and services during the tax season and throughout the calendar year.

For a free, no obligation quote, call Davette at 715-339-6638. Her office is located between the lion statues at 164 South Lake Avenue in Phillips.